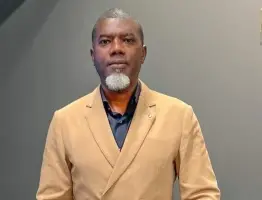

A journalist, Mr. Musliudeen Atanda Adebayo, has petitioned the Economic and Financial Crimes Commission (EFCC), Central Bank of Nigeria (CBN), and the Public Complaints Commission (PCC) to intervene in a dispute with NIRSAL Microfinance Bank over an alleged sudden increase in his loan interest rate.

Adebayo, in his petition submitted to the three agencies on Friday, urged them to prevent NIRSAL Microfinance Bank from making further deductions from his account after he claims to have fully repaid his loan with the initially agreed 15% interest.

COVID-19 Grant Turned Loan

According to the petition, Adebayo received ₦180,000 in 2020 during the COVID-19 pandemic, which he believed was a grant. He later discovered it was actually a loan that required repayment with interest.

"We thought that it was grant at that time. No message was sent to me until August 2023," Adebayo stated in his petition. He explained that upon receiving notification about the repayment in August 2023, he approached the bank's Dugbe branch in Ibadan and was informed he needed to repay the principal amount plus 15% interest, totaling ₦207,000.

Repayment History and Dispute

The journalist detailed his repayment history, which included multiple installments between August 2023 and May 2025. These payments included several manual deposits and automatic deductions through GIS recovery, which he claims fully covered the principal amount and the agreed 15% interest.

"I have paid the principal amount (₦180,000) and the interest of fifteen per cent (₦27,000). I am not owing the bank and I want the account to be closed," Adebayo asserted.

However, when he approached the bank to close his account, he was reportedly informed that he still owed an additional ₦18,000, which he claims represents an unannounced increase in the interest rate from 15% to 25%.

Appeal for Intervention

In his petition, Adebayo expressed frustration at being unable to resolve the matter directly with the bank. "I have exhausted all the necessary avenues to resolve this matter amicably but the manager and the staff of NIRSAL Microfinance Bank at Dugbe Ibadan are still insisting that they will still deduct money from my account," he stated.

The journalist is seeking intervention from the regulatory bodies to prevent further deductions from his account and to facilitate the closure of his account with the microfinance institution.

"I am using this medium to appeal to you to use your good office to ensure that all these requests are granted," Adebayo concluded in his petition.

As of the time of this report, responses from EFCC, CBN, and PCC regarding the petition were not yet available.

This case highlights potential concerns about transparency in microfinance lending practices, particularly regarding loans disbursed during the COVID-19 pandemic period.

Stay connected with BenriNews for updates on this developing story and more financial news across Nigeria.

Follow us on social media for the latest updates: